Watch the teleconference recording

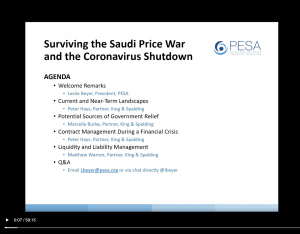

As the energy industry focuses on managing the downturn and preparing to thrive once demand returns, PESA hosted King and Spalding partners Peter Hays, Marcella Burke and Matt Warren to discuss initial reactions of companies and lenders in the industry and short- and long-term strategies being used to navigate the crisis and manage financial distress.

In the current landscape, Hays noted that refineries declining to accept oil has a greater impact on the supply chain than the WTI price. Hays also noted the strong correlation between the economy and oil prices and said it’s likely that as the global economy begins its recovery, demand will increase, and the price of oil will climb.

POTENTIAL SOURCES OF GOVERNMENT RELIEF

COVID-19 shutdowns have hurt every sector of the economy and federal, state and local governments are taking measures to ease the financial burden while managing the health crisis. Burke explained that the size and nature of the current economic situation calls for a different response from the government than the 2008 recession.

The 2008 recession was a liquidity crisis, but the pandemic is causing a demand shock. Federal lawmakers responded with the largest emergency stimulus package in U.S. history. With oil company executives and President Trump meeting, Burke said the next steps from the federal government could include talks with Saudi Arabia and the inclusion of Strategic Petroleum Reserves purchases in the next stimulus package.

Burke reviewed Small Business Administration and Department of Treasury loan programs passed in the CARES act. PESA has compiled information relevant to oilfield service and equipment companies on those forms of aid.

CONTRACT MANAGEMENT DURING A FINANCIAL CRISIS

In the current environment, Hays cautioned attendees to review force majeure clauses in their contracts. The financial crisis or dramatic changes in oil prices may not meet the requirements for invoking a force majeure provision.

When companies receive these claims, Hays advised companies to consider how performance could be altered to comply with new COVID-19 orders and ensure the contract remains in effect. Hays pointed out that companies could issue valid force majeure claims while an upstream notice may be invalid.

LIQUIDITY AND LIABILITY MANAGEMENT

Warren closed the teleconference with advice about maintaining liquidity and making decisions about restructuring alternatives. As companies manage significant reductions in revenue, he suggested a thorough assessment of liquidity, evaluating which payments could be delayed, determining whether a strategic merger/acquisition transaction is achievable, obtaining additional liquidity to cover cash shortfalls, and contingency planning if cash is depleted and alternatives can’t be obtained.

If restructuring is necessary, Warren strongly urged companies to begin planning as soon as possible.

“The earlier you start, the more options you have,” he said.

A restructuring strategy should identify an achievable plan to meet the company’s needs while maximizing value for stakeholders, balance capital structure between current financial performance and reasonable future business projections and position the company for long-term sustainable success.

PESA is committed to providing the latest information and best practices to help Members manage unprecedented events. We have already hosted multiple remote events, with resources and outcomes on our COVID-19 landing page. If you would like to learn more about PESA’s efforts during the COVID-19 crisis, please contact Tim Tarpley, Vice President Government Affairs.