Analysis by Energy Workforce President Tim Tarpley

On Wednesday, the SEC voted on its long-delayed final rule requiring US companies to disclose climate impacts from their operations. This rule was first proposed in March 2022. The initial proposal would have divided disclosures into Scope 1, which is direct emissions the company produces from its operations; Scope 2, indirect emissions; and Scope 3, which is emissions from their supply chains and producers. Scope 3 faced the most scrutiny from industry and trade groups, as noted in EWTC’s original comments (link included) on the issue. All in all, the SEC received 15,000 comment letters on this proposal, which is more than they have ever received for any proposed rule in the history of the agency. It is likely that the Commission chose to scale back the Scope 3 reporting requirements due to fears that the rule may be challenged in court and the 2022 Supreme Court decision curbing the EPA’s authority to regulate emissions certainly does suggest that the agency may not have sufficient authority to legally defend the initial proposed rule. While the new version of the rule is by no means judgment-proof, and many questions remain, it does appear more sustainable than the original.

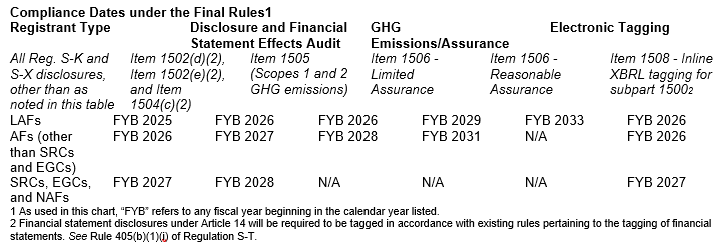

In the final rule, the SEC ended up pulling Scope 3 entirely and softening the requirements for Scope 1 and 2. Under the final rule, companies will only be required to make these submissions for data that they deem to have had or are reasonably likely to have a material impact on the registrant’s strategy, business model, and outlook. This materiality standard was a requested change by many in the industry from the original proposed rule. The rule will become effective 60 days after the rule is published in the federal register; however, the actual implementation will depend on the type of filer and other factors. The detailed timeline provided by the SEC is included below. In short, the SEC will require registrants to disclose:

- Climate-related risks that have had or are reasonably likely to have a material impact on the registrant’s business strategy, results of operations, or financial condition;

● The actual and potential material impacts of any identified climate-related risks on the registrant’s strategy, business model, and outlook;

● If, as part of its strategy, a registrant has undertaken activities to mitigate or adapt to a material climate-related risk, a quantitative and qualitative description of material expenditures incurred and material impacts on financial estimates and assumptions that directly result from such mitigation or adaptation activities;

● Specified disclosures regarding a registrant’s activities, if any, to mitigate or adapt to a material climate-related risk including the use, if any, of transition plans, scenario analysis, or internal carbon prices;

● Any oversight by the board of directors of climate-related risks and any role by management in assessing and managing the registrant’s material climate-related risks;

● Any processes the registrant has for identifying, assessing, and managing material climate-related risks and, if the registrant is managing those risks, whether and how any such processes are integrated into the registrant’s overall risk management system or processes;

● Information about a registrant’s climate-related targets or goals, if any, that have materially affected or are reasonably likely to materially affect the registrant’s business, results of operations, or financial condition. Disclosures would include material expenditures and material impacts on financial estimates and assumptions as a direct result of the target or goal or actions taken to make progress toward meeting such target or goal;

● For large accelerated filers (LAFs) and accelerated filers (AFs) that are not otherwise exempted, information about material Scope 1 emissions and/or Scope 2 emissions;

● For those required to disclose Scope 1 and/or Scope 2 emissions, an assurance report at the limited assurance level, which, for an LAF, following an additional transition period, will be at the reasonable assurance level;

● The capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds, disclosed in a note to the financial statements;

● The capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates (RECs) if used as a material component of a registrant’s plans to achieve its disclosed climate-related targets or goals, disclosed in a note to the financial statements; and

● If the estimates and assumptions a registrant uses to produce the financial statements were materially impacted by risks and uncertainties associated with severe weather events and other natural conditions or any disclosed climate-related targets or transition plans, a qualitative description of how the development of such estimates and assumptions was impacted, disclosed in a note to the financial statements.

What does this all mean for companies in the energy services and equipment sector? First, even with the scaled-back nature of the final rule, there is no doubt that companies will still face significant consequences of this action. First, there will be increased costs due to the reporting and data collection needed to comply with the rule. However, these costs will not be as significant as first considered with the proposed rule as most public companies are already collecting the required date for other forms of reporting or at the request of customers. The reporting will also naturally put pressure on companies to update older technology that add to their emissions profile. However, at the same time, this added pressure will lead to a greater demand for technology, which lowers emissions, increasing overall demand. It will be vital for companies in our sector to capitalize on this new market. Secondly, we can expect increased activism from shareholders and outside groups. With all of this data easily accessible it appears inevitable that it will be targeted by opponents of the industry. However, like the first consideration, this consequence will be less significant than with the proposed rule as much of this data is already public for most companies. And third, unfortunately closely tied to the second, there may be increased litigation spurred by the disclosures in the rule. Generally speaking, the more data that becomes public, the more this data can be used to support litigation from outside groups looking to target the industry. This risk has been somewhat diminished by the changes made in the final rule… but it still exists.

What happens next? Well the political climate regarding ESG has changed dramatically since the rule was first proposed. Many of the “ESG funds” that were all the rage a few years ago have started to see outflows and many have shut down entirely. Much of this has been due to investor uncertainty as to how to define and measure ESG, in addition to ESG becoming highly politicized with a number of states taking legal steps to prevent ESG-targeted investing.

The final rule will require reporting to start on a sliding scale dependent on the type of filer and type of data starting in 2025 and going all the way through 2033. Given the scaled-back nature of the rule itself, the rush to politicize it and for Congress to disapprove of the rule may be muted to some extent. While we can certainly expect ESG to continue to be politicized in the coming election this rule may not be the target of as much criticism as it would have been had it stayed in the proposed form. The House may move to pass a formal disapproval resolution of the rule, but the reality is this will be largely symbolic. The resolution would likely not pass the Senate, and even if it did, it would not have enough votes to sustain a presidential veto, which President Biden would almost surely undertake. However, should there be a switch in administrations in January of 2025, it is possible that there could be efforts to nullify or amend portions of the rule.

EWTC will launch a series of webinars to help our companies prepare for the reporting that is required in this rule and for the other secondary implications. The first webinar will be on March 25, 2024. EWTC also has launched the Energy Sustainability Reporting Program which allows students to take a detailed training program that will prepare them not only for the SEC reporting but methane, TCFD and other frameworks as well.

Tim Tarpley, Energy Workforce President, analyzes federal policy for the Energy Workforce & Technology Council. Click here to subscribe to the Energy Workforce newsletter, which highlights sector-specific issues, best practices, activities and more.