BY SEAN HANLEY, PICKERING ENERGY PARTNERS

As everyone is aware, 2024 is an election year. You probably also have heard about the recent news regarding the Biden Administration’s recent decision to freeze new LNG export projects. Let us examine why he did it, what it means for US companies and subsequently, importing countries who need our LNG to create electricity used to power daily life. In a perfectly competitive market, consumers will choose the lower priced good or service, ceteris paribus. Energy consumption is a “zero sum” game, meaning that electricity demand will remain constant, if not increasing, and the electricity source is relatively elastic. In other words, if LNG supply is no longer available, governments, municipalities, and utility companies will substitute other sources of electricity generation, namely coal, because of its affordability as well as reliability in terms of shipping logistics. Many European nations such as Germany are retiring nuclear plants without bringing new plants online, thus further destabilizing local grids. Let me walk you through the various sources of electricity leveraged by the United States and how our consumption profile differs from the rest of the world.

Let’s first gain a better understanding of global energy consumption, then specifically, what the primary sources of electricity creation are. According to a study done by OurWorldInData total energy consumption experienced a 45% increase from 122,857 TWh (terawatt-hours) to 178,899 TWh from 2000-2022. In 2000, renewables (hydro, solar, wind, bioenergy, wave, tidal, others) accounted for 4% of energy produced. As of 2022, renewable sources of energy now account for 11% of energy production.[1] Traditional fossil fuels (coal, oil, & natural gas) currently supply approximately 80% of the world’s energy. The movement towards leveraging renewables as primary sources of energy is proving to be costly and inefficient when compared to cheaper and more reliable fossil fuels.

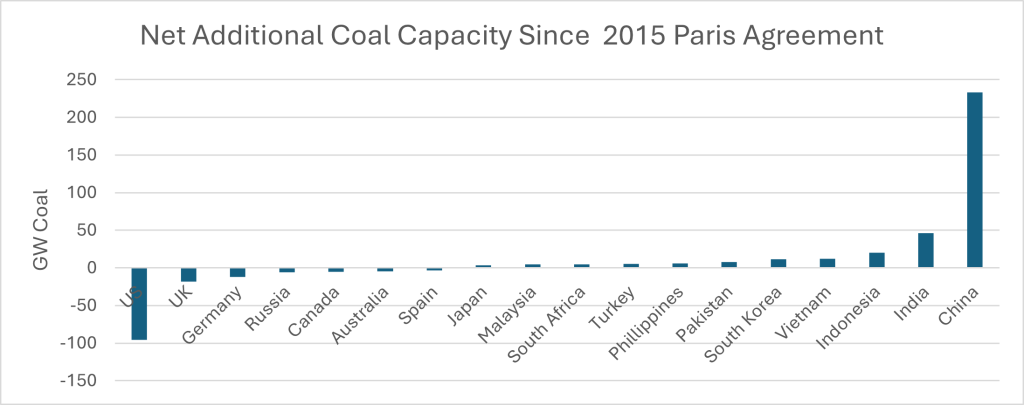

One can quickly understand why coal consumption reached an all-time high in 2023. The weighted average cost of coal is $2.36 per MMBtu, while petroleum and natural gas are significantly more costly at $16.53 and $7.21 per MMBtu respectively. [2] The relative abundance and affordability are driving demand in two primary coal consuming countries, India and China. The chart below highlights Net Coal Capacity changes since the 2015 Paris Agreement.[3]

In 2023, China accounted for 55% of global consumption and imported 325 million tons, up 109 million tons from 2022! India imported 172mm tons in 2023 which trailed only China. China saw a 4.6% increase in coal demand while India experienced a 9% increase! The U.S. observed an 8% decline YoY.

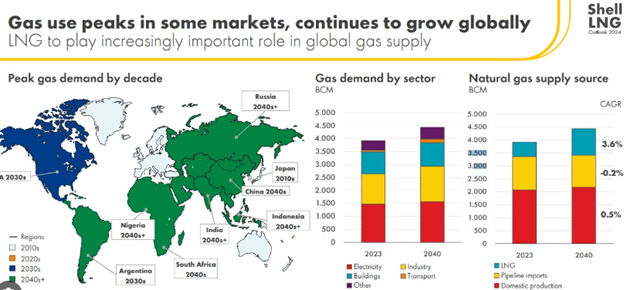

As industrial coal-to-gas switching accelerates in China and South/Southeast Asia, global demand is estimated to grow by over 50%. Demand is expected to reach 625-685 million metric tons per year by 2040. China’s imports are expected to grow to nearly 80mm tons according to Shell.[4]

With approximately 60-65% of the world’s electricity generated from natural gas and coal one must question the reasoning and judgment behind the Biden Administration’s decision to “pause” new LNG projects. If the cheapest and most reliable substitute for a lack of LNG supply would be to burn coal to power global grids, aren’t we just trading a methane problem for a carbon dioxide (CO2), Sulfur Dioxide (SO2), and volatile organic compound (VOC) problem? We all know renewables are an inconsistent source of power, and grids are only able to store their energy for hours as opposed to days (which is essential to surviving in the most extreme temperatures). It has been empirically proven that coal is more carbon-intensive than natural gas or petroleum for power production, so why are we taking steps backward in human evolution rather than forward? Perhaps because the climate activists will also remember to vote in November…

[1] https://ourworldindata.org/energy-mix

[2] https://www.eia.gov/electricity/annual/html/epa_07_04.html

[3] https://eprinc.org/wp-content/uploads/2023/11/EPRINC-Chart2023-44-GlobalPowerPlantAdditionsSinceTheParisAccords-Version1.pdf

[4] https://www.shell.com/energy-and-innovation/natural-gas/liquefied-natural-gas-lng/lng-outlook-2024.html

Energy Workforce partner Pickering Energy Partners provides insights on ESG due diligence, disclosures and reporting. Sean Hanley serves as the Director or ESG Strategy & Implementation.