BY GARRETT DELK, PICKERING ENERGY PARTNERS

Dual legislation in the U.S. and EU aims to prove emissions efficiency in key products across conventional energy, mining, renewables and the energy transition spaces. In June 2023, the U.S. introduced the Providing Reliable, Objective, Verifiable Emissions Intensity and Transparency (PROVE IT) Act which, if passed, would direct the Department of Energy (DOE) to conduct a study comparing the greenhouse gas emissions intensity of certain goods produced in the United States to the emissions intensity of those same goods produced in other countries. Similarly, in October 2023 the EU’s Carbon Border Adjustment Mechanism (CBAM) came into effect which intends to put a price on the carbon emitted during the production of many of the same imported goods covered under PROVE IT.

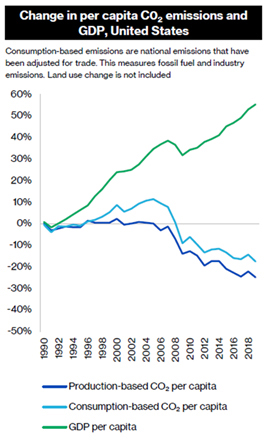

Together these two pieces of cross-Atlantic regulation aim to simultaneously prove the emissions efficiency of manufacturing and production in the U.S. and Western countries while attempting to level the economic playing field with dirtier producers. The impetus for carbon pricing regulation is particularly cogent for the U.S., as we’ve proven able to walk and chew gum at the same time. Put simply, we’ve shown we can grow GDP while also lowering GHG emissions (see visual). Empirically vindicated, this fact has been accomplished in large part by technology breakthroughs and emissions efficiencies adopted along the traditional U.S. energy value chain, many products of which are covered by PROVE IT and CBAM — specifically crude oil, refined petroleum products and natural gas.

Additionally, PROVE IT and CBAM also cover goods produced related to mining, renewables and the energy transition such as lithium-ion batteries, critical minerals (copper, cobalt, lithium, nickel, etc.), solar cells, uranium and wind turbines. This is strategically significant as U.S. and other Western companies within these nascent industries compete for global market share. For example, we have strong regulations, efficient and advanced manufacturing, and relatively clean power generation. While these factors tend to result in lower-carbon domestic products, they also add costs for American companies, which often gives dirtier foreign competition a financial advantage. Thus, PROVE IT and CBAM endeavor to level that playing field by calculating the carbon intensity of certain domestic and foreign products and then imposing a carbon fee on the extra carbon footprint of products imported into the EU, and eventually the U.S.

Ultimately for U.S. energy producers the takeaways are twofold. First, net-zero pressure from capital market participants is fading, the tradeoff is that energy producers provide quantitative disclosure to investors. As exemplified by PROVE IT and CBAM emissions related policy is evolving in a more quantitatively based fashion. Conventional U.S. energy companies need to consider disclosure in order to capture premiums associated with the responsible production of key raw materials (i.e. oil and natural gas). Second, many U.S. energy companies are likely ready to disclose quantitative data but face a daunting task of where to begin. Pickering recommends incremental steps toward accretion, but starting on disclosure is key to win both a level of regulatory protection and public/private investor interest.

Energy Workforce partner Pickering Energy Partners provides insights on ESG due diligence, disclosures and reporting. Garrett Delk is an Associate, specializing in ESG Advisory.