Analysis by Energy Workforce SVP Government Affairs & Counsel Tim Tarpley

Energy Workforce has serious concerns about the implications of the recently signed Inflation Reduction Act (IRA) provisions, such as the methane fee and royalty rate increases and how these will increase the cost of U.S. production of oil and natural gas. However, in addition to the many challenging aspects of the bill which will be discussed below, there are also a few opportunities for Energy Workforce Members that are worth noting. As these programs begin to go into effect, Energy Workforce will work closely with the relevant agencies to ensure that OFS companies are able to participate.

Expansion of Current Tax Credits for New Energy Production

Many of the most relevant opportunities for Energy Workforce Members can be found in the expansions, extensions and creations of new tax credits for manufacturing technology and new energy. Notably, the Inflation Reduction Act extends the investment tax credit (ITC) from 6% to 30% for solar, geothermal, biogas, fuel cells, waste energy recovery, combined heat and power, small wind property, and microturbine and microgrid property for projects beginning construction before January 1, 2025.

It also extends the production tax credit (PTC) to 2.6 c/kWh for wind, biomass, geothermal, solar, landfill gas, municipal solid waste, qualified hydropower, and marine and hydrokinetic resources for projects beginning construction before January 1, 2025, IF

- pays prevailing wages during the construction phase and for the first five years of operation and

- meets registered apprenticeship requirements.

These requirements will be applicable to both contractors and subcontractors. Details of how far along in the chain these requirements will go need to be clarified at a later date by the Department of Labor.

Creation of New Credits

In addition to this extension of the ITC, the bill also extends, expands and creates a number of new Production Tax Credits (PTC) that may be of interest to our membership. Of note to those involved in carbon capture activities, the legislation extends 45Q tax credits through 2032 and creates the opportunity to receive direct pay for the first five years.

In the case of facilities placed in service after 2022, the credit amount for those calendar years beginning before 2017 will be fixed at $85 per metric ton ($17 “base”/$85 maximum) if the captured carbon is sequestered and at $60 per metric ton ($12 “base”/$60 maximum) if it is used as a tertiary injectant in an EOR project or for an otherwise permitted purpose. For subsequent years, this maximum amount is inflation-adjusted.

In the case of “direct air capture facilities,” the Act increases the applicable credit amount to $180 per metric ton ($36 “base”/$180 maximum) of carbon oxide captured and sequestered and to $130 per metric ton ($26 “base”/$130 maximum) of carbon oxide captured and used as a tertiary injectant in an EOR project or for an otherwise permitted purpose. The Act also significantly reduces the threshold amounts of carbon oxide required to be captured in order to qualify for the credit.

Given these changes to 45Q, it is fair to say that the market for carbon capture in the United States is fundamentally changed. The extension to 2032 and the increase to $85 will likely make carbon capture in many areas financially viable. We can expect a significant influx of capital into this space.

Tim Tarpley, SVP Government Affairs & Counsel, Energy Workforce & Technology Council

IRA also creates a new Section 45V, which provides a new two-tier, inflation-adjusted, 10-year PTC for clean hydrogen produced at a qualified facility, the construction of which begins before 2033. The annual credit amount will equal

- The number of kilograms of qualified clean hydrogen produced by the taxpayer

- Multiplied by the available credit amount (60 cent “base”/$3 maximum)

- Multiplied by the applicable rate (i.e., 20%, 25%, 33.4% or 100% depending on the project’s lifecycle greenhouse gas emission rate)

The act defines “qualified clean hydrogen” as hydrogen produced through a process that results in a lifecycle greenhouse gas emission rate of 4 kilogram of CO2e or less. Of particular note is that no credit may be taken for qualified clean hydrogen produced at a facility that includes carbon capture equipment for which a credit is allowed to any taxpayer under Section 45Q for the taxable year or any prior taxable year. This provision is intended to prevent “double dipping.”

For both 45Q and 45V, the credits are designed to be claimed by the owner of the facility that produces the power or sequesters the carbon. However, the IRA also creates a new section that allows for easier transfer of credits among other entities involved in the process. Therefore, we can expect that technology providers and others can share these credits along with their partners.

The Inflation Reduction Act also creates Section 45X, which is a brand-new credit that provides a PTC for manufacturers of eligible components that are produced and sold. Eligible components include specific components used in wind, solar and battery projects, including blades, nacelles, wind turbine towers, PV cells, PV wafers, certain inverters, solar grade polysilicon, polymeric backsheets, solar modules, torque tubes, structural fasteners, electrode active materials, battery cells, battery modules and certain critical minerals. The Section 45X credit begins phasing out in 2030 and is not available for components sold after 2032.

Creation of a Green Bank and Expansion of Loan Guarantees

Energy Workforce Members should also follow the implementation of the $27 billion “Green Bank” in the Inflation Reduction Act. The Green Bank includes $12 billion in financing for the rapid deployment of low-emissions or zero emissions technology investments and $7 billion to finance community-based zero-emissions technology. The money is distributed in grants to non-profit organizations who then can purchase the technology directly.

Also included is a $250 billion loan guarantee program for energy infrastructure and power development geared towards facilities and equipment for the generation or transmission of electric energy and the production, processing and delivery of fossil fuels. Many technologies which fit the intentions of this program include those produced by Energy Workforce companies including:

Innovative Technology Program (General)

- Renewable energy systems (“Renewable Energy Projects”)

- Hydrogen fuel cell technology for residential, industrial or transportation applications (“Hydrogen Projects”)

- Carbon capture, utilization and sequestration practices and technologies, including agricultural and forestry practices that store and sequester carbon and synthetic technologies to remove carbon from the air and oceans (“Carbon Capture Projects”)

- Efficient electrical generation, transmission, and distribution technologies (“Efficient Electrical Projects”)

- Efficient end-use energy technologies (“Efficient End-Use Projects”)

- Production facilities for the manufacture of fuel-efficient vehicles or parts of those vehicles, including electric drive vehicles and advanced diesel vehicles (“Fuel-Efficient Vehicle Projects”)

- Pollution control equipment (“Pollution Control Projects”)

- Energy storage technologies for residential, industrial, transportation, and power generation applications (“Energy Storage Projects”)

- Technologies or processes for reducing greenhouse gas emissions from industrial applications, including iron, steel, cement, and ammonia production, hydrogen production and the generation of high-temperature heat (“Industrial GHG Reduction Projects”)

Innovative Technology Program (Fossil)

- Advanced fossil energy technology

- Hydrogen fuel cell technology for residential, industrial or transportation applications

- Carbon capture, utilization and sequestration practices and technologies, including agricultural and forestry practices that store and sequester carbon and synthetic technologies to remove carbon from the air and oceans

- Efficient electrical generation, transmission and distribution technologies

- Efficient end-use energy technologies

- Production facilities for the manufacture of fuel-efficient vehicles or parts of those vehicles, including advanced diesel vehicles

- Pollution control equipment

- Energy storage technologies for residential, industrial, transportation and power generation applications

- Refineries, meaning facilities at which crude oil is refined into gasoline

- Technologies or processes for reducing greenhouse gas emissions from industrial applications, including iron, steel, cement and ammonia production, hydrogen production and the generation of high-temperature heat

The EPA is also granted $1.5 billion to promote methane detection and measurement in the oil and gas sector. $850 million of these grants goes to facilities subject to the methane charge and the other $700 million goes specifically to “marginal conventional wells” for the same purpose. This offset is meant to provide relief to companies that are specifically hit by the methane fee discussed below. Assuming that the methane fee goes into effect, this provision could spur spending on methane leak detection and reduction equipment produced by our sector.

Methane Fee

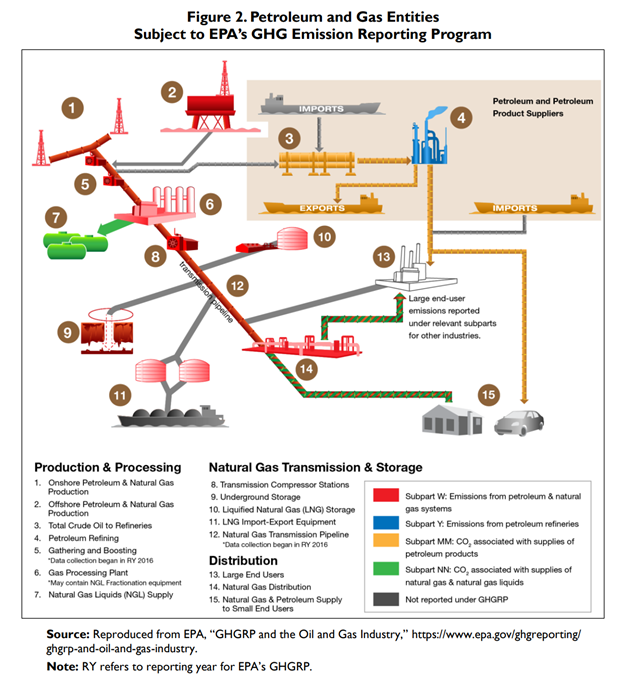

Perhaps the most potentially negative provision in the bill for our sector is the creation of a new methane fee that is to be levied on a wide variety of activities in the production of oil and gas. The IRA creates a methane emissions charge that would apply only to methane emissions from specific types of facilities (facilities included listed below in Figure 2) that are required to report their greenhouse gas (GHG) emissions to the Environmental Protection Agency’s (EPA’s) Greenhouse Gas Emissions Reporting Program (GHGRP). The charge in IRA would start in calendar year 2024 at $900 per metric ton of methane, increase to $1,200 in 2025 and increase to $1,500 in 2026. The charge would remain at $1,500 in subsequent year. When enacted, this charge would be the first time the federal government would directly impose a charge, fee or tax on GHG emissions.

As written, this provision could have significant negative effects on the production of oil and gas in the United States by adding a new cost right at the time that the world demand for energy peaks. However, due to carve-out provision in the language, it is very hard to gauge at this time if and who this provision would actually be applied to.

The bill says that businesses will be exempt from the methane fee if the EPA methane regulation (which has not been released yet and is expected in the fall) is in effect in all 50 states and would result in equivalent or greater emissions reductions as would be achieved by the draft November 2021 rule. So, if the regulation the EPA ultimately releases is weaker, then the fee applies. If the regulation is released and is successfully challenged in one federal district in court, then the fee applies. A piece of legislation written in this way is incredibly rare and it is very possible this provision on its own does not stand up in court. Energy Workforce will continue to monitor the implementation of this provision closely.

Federal Lands Provisions

Like the bill as a whole, the federal lands provisions are a bit of a mixed bag for our industry. The legislation:

- raises onshore royalty rates to 16.66% from 12.5% currently

- raises offshore royalty rates to 16.66% from 12.5% currently

- increases the minimum bid rate to $10/acre from $2/acre

- institutes a $5/acre fee for operators to informally nominate lease tracts inclusion in lease sales

The bill also includes language that says the Department of Interior must hold oil and gas lease sales in order to hold equivalent lease sales for wind or right of way for solar development. However, the Biden Administration has used many delay tactics in the past to avoid holding such sales, so the actual relevance of this provision is in question. It is also possible that the Department could choose to hold only unattractive lease sales as a way to satisfy this requirement.

Tax Provisions

In addition to the methane fee potentially raising the cost of doing business to OFS companies, there are a number of new tax provisions worth noting. The IRA creates a new 1% excise tax on the market value of stock a corporation buys back during the tax year. This provision takes effect after December 31, 2022. Additionally, per the IRA, starting after December 31 of this year corporations that have an Adjusted Financial Statement Income of over $1 billion will pay a 15% Alternative Minimum Tax.

Perhaps the most controversial addition is the bill also provides for $80 billion through September 2031 for additional agents and infrastructure at the IRS to increase enforcement. This provision is a huge political target for Republicans, so there could certainly be efforts to repeal or alter this provision depending on the outcome of the midterm elections.

If you would like to get involved with Energy Workforce advocacy efforts or the Government Affairs Committee, contact SVP Government Affairs Tim Tarpley.

Tim Tarpley, SVP Government Affairs & Counsel, analyzes federal policy for the Energy Workforce & Technology Council. Click here to subscribe to the Energy Workforce newsletter, which highlights sector-specific issues, best practices, activities and more.